Updated: Boston Real Estate Blog 2025

Byline – John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114

Boston Real Estate: Mortgage interest rates

Boston Condos for Sale and Apartments for Rent

Boston Real Estate: Mortgage interest rates

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.95% last week from 6.97% the previous week.

- Applications to refinance a home loan jumped 10% compared with the previous week and were 33% higher than the same week one year ago.

- Applications for a mortgage to purchase a home declined again, falling 2% for the week.

Boston Real Estate: Mortgage interest rates

The interest rate on a 30-year fixed-rate mortgage is 6.250% as of February 9, which is 0.375 percentage points lower than yesterday. Additionally, the interest rate on a 15-year fixed-rate mortgage is 5.750%.

Updated: Boston Condos for Sale Website – 2024

__________________

Boston Real Estate: Mortgage interest rates

_______________________________________________________________________________________________

Updated: Boston real estate blog 2022

Boston Real Estate: Mortgage interest rates

Mortgage interest rates up slightly but still very low

It takes a long time for most of us to actually own a house. At first, the bank or mortgage lender is the primary owner and we make payments. Eventually, homeownership is possible.

mortgage interest rates have an impact on the housing market. When rates go up some buyers will get cold feet even though the rates are only slightly over 3% on a thirty-year conforming mortgage. The common wisdom is that rates are more likely to go up than down because inflation is on the rise.

Rates were higher in March of 2021 at an average of 3.17% for a 30-year mortgage. In March of 2020, they were around 3.65%.

Mortgage rates Boston condos

This could be a better time to buy a Boston condo for sale than next March when rates will be higher.

_____________________________________________________________

Boston Condos for Sale

Loading...

Boston Real Estate: Mortgage interest rates

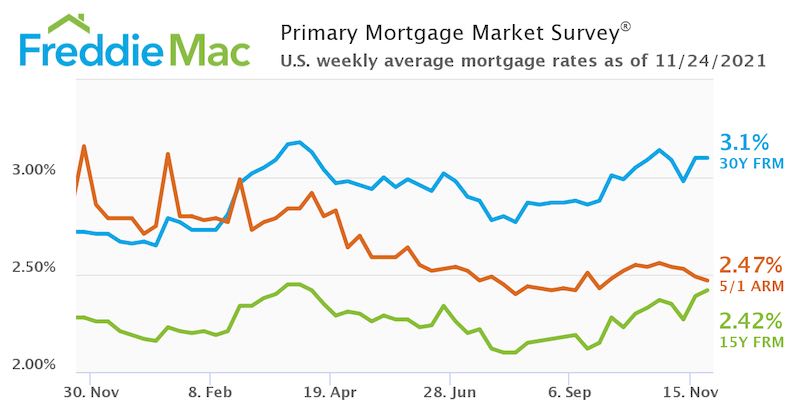

With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since experts project rates will rise further in the coming months, that conversation isn’t going away any time soon.

But as a Boston condo for sale buyer, what do rates above 3% really mean?

Today’s Average Mortgage Rate Still Presents Buyers with a Great Opportunity

Buyers don’t want mortgage rates to rise, as any upward movement increases your monthly mortgage payment. But it’s important to put today’s average mortgage rate into perspective. The graph below shows today’s rate in comparison to average rates over the last five years:

As the graph shows, even though today’s rate is above 3%, it’s still incredibly competitive.

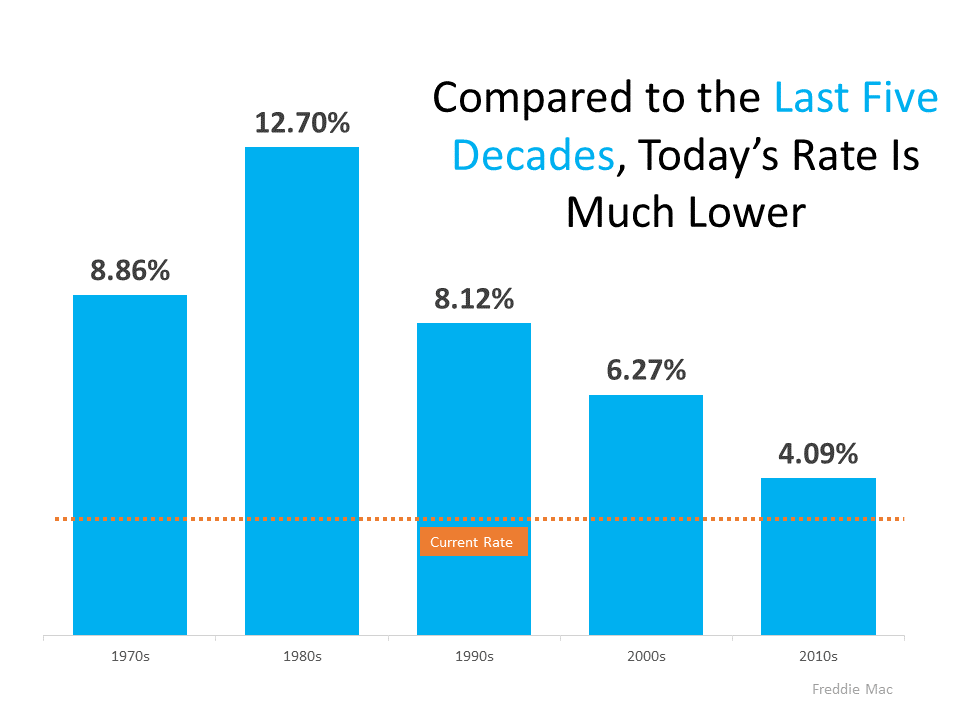

But today’s rate isn’t just low when compared to the most recent years. To truly put today into perspective, let’s look at the last 50 years (see graph below):

When we look back even further, we can see that today’s rate is truly outstanding by comparison.

What Does That Mean for You as a Boston condo buyer?

Being upset that you missed out on sub-3% mortgage rates is understandable. But it’s important to realize, buying now still makes sense as experts project rates will continue to rise. And as rates rise, it will cost more to purchase a home.

As Mark Fleming, Chief Economist at First American, explains:

“Rising mortgage rates, all else equal, will diminish house-buying power, meaning it will cost more per month for a borrower to buy ‘their same home.’”

In other words, the longer you wait, the more it will cost you.

Boston Condo Mortgage Rates and the Bottom Line

While it’s true today’s average mortgage rate is higher than just a few months ago, 3% mortgage rates shouldn’t deter you from your homebuying goals. Historically, today’s rate is still low. And since rates are expected to continue rising, buying now could save you money in the long run. Let’s connect so you can lock in a great rate now.

Boston Condos for Sale

Loading...

________________________________________________________________

Boston Condos for Sale

Loading...

Boston Real Estate: Mortgage interest rates

Mortgage rates continued their trudge higher last week, leaving most homeowners with little to no incentive to refinance. Homebuyers, already battling a pricey market, lost more purchasing power due to those higher rates.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.18% from 3.14%, with points rising to 0.37 from 0.35 (including the origination fee) for loans with a 20% down payment. That is the highest rate since June of this year. Rates are up 15 basis points in the past month.

Applications to refinance a home loan fell 1% for the week and were 16% lower than the same week one year ago. The refinance share of mortgage activity decreased to 63.9% of total applications from 64.5% the previous week.

Boston Condos for Sale

Loading...

Click Here to view: Google Ford Realty Inc Reviews

________________________________________________________________________________________________________________________

Boston Real Estate for Sale

Last Thursday, Freddie Mac announced that their 30-year fixed mortgage rate was over 3% (3.02%) for the first time since last July. That news dominated downtown Boston real estate headlines that day and the next. Articles talked about the “negative impact” it may have on the housing market. However, we should realize two things:

1. The bump-up in rate should not have surprised anyone. Many had already projected that rates would rise slightly as we proceeded through the year.

2. Freddie Mac’s comments about the rate increase were not alarming:

“The rise in mortgage rates over the next couple of months is likely to be more muted in comparison to the last few weeks, and we expect a strong spring sales season.”

A “muted” rise in rates will not sink the real estate market, and most experts agree that it will be “a strong spring sales season.”

What does this mean for you as a Boston condo owner or buyer?

Obviously, any buyer would rather mortgage rates not rise at all, as any upward movement increases their monthly mortgage payment. However, let’s put a 3.02% rate into perspective. Here are the Freddie Mac annual mortgage rates for the last five years:

- 2016: 3.65%

- 2017: 3.99%

- 2018: 4.54%

- 2019: 3.94%

- 2020: 3.11%

Though 3.02% is not as great as the sub-3% rates we saw over the previous seven weeks, it’s still very close to the all-time low (2.66% in December 2020).

And, if we expand our look at mortgage rates to consider the last 50 years, we can see that today’s rate is truly outstanding. Here are the rates over the last five decades:

- 1970s: 8.86%

- 1980s: 12.7%

- 1990s: 8.12%

- 2000s: 6.29%

- 2010s: 4.09%

Being upset that you missed the “best mortgage rate ever” is understandable. However, don’t throw the baby out with the bathwater. Buying a Boston condominium, now still makes more sense than waiting, especially if rates continue to bump up this year.

Boston Real Estate and the Bottom Line

It’s true as a Boston downtown real estate buyer that you may not get the same rate you would have five weeks ago. However, you will get a better rate than what was possible at almost any other point in history. Let’s connect today so you can lock in a great rate while they stay this low.

Boston Real Estate for Sale

Updated: Boston Real Estate Blog 2021