First-time homebuyers hit record low, average age hits record high

Boston Condos for Sale and Apartments for Rent

First-time homebuyers hit record low, average age hits record high

Updated: Boston Real Estate Blog 2025

Ford Realty Inc., Boston Real Estate for Sale

Click to View Google Review

Visit our office at 137 Charles Street Rear, Boston MA 02114

First-time homebuyers hit record low, average age hits record high

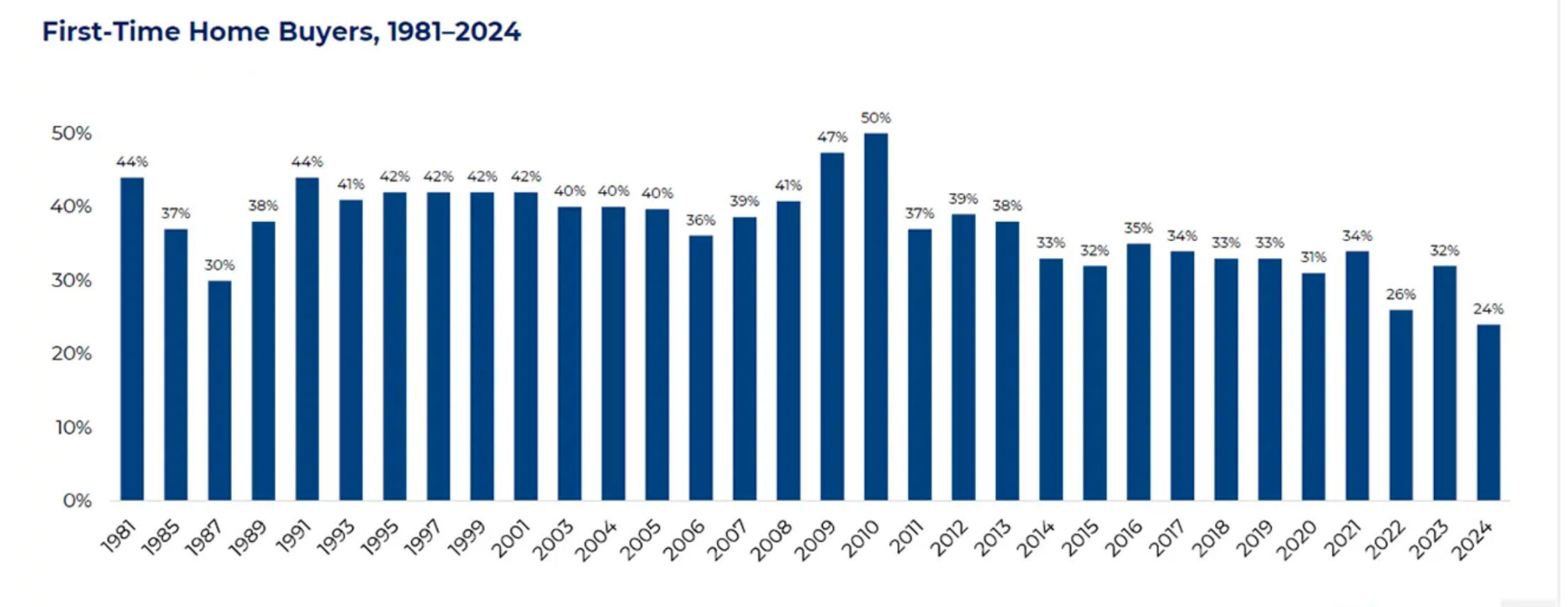

The market share of first-time homebuyers has dropped to 24%: a historic low, according to the National Association of REALTORS® (NAR).

The median homebuyer age also hit a record-high of 56.

These are among the key takeaways from NAR’s annual Profile of Home Buyers and Sellers, which the association has produced for more than four decades. This year’s edition looks at the period between July 2023 and June 2024 with data collected from a nationally representative sample of recent homebuyers and sellers.

First-time homebuyers

The drop in first-time homebuyers, to a market share of 24%, represents an 8% decline year over year. For context, prior to 2008, the share of first-time buyers hovered around 40%.

Meanwhile, the age of first-time buyers rose by three years, hitting 38. That’s about 10 years older than first-time homebuyers were in the 1980s, when NAR began tracking the data.

Their household income grew as well, reaching a median of $97,000. That’s up $1,100 from last year and up a whopping $26,000 from the end of 2022.

The median down payment for first-time buyers was also record-setting, representing 9% of the sales price — the highest down-payment share for that group since 1997. Sixty-nine percent of those buyers reported using savings for that down payment while 25% used loans or gifts.

“First-time buyers face high home prices, high mortgage interest rates and limited inventory, making them a decade older with significantly higher incomes than previous generations of buyers,” NAR Deputy Chief Economist and Vice President of Research Jessica Lautz said in a press release accompanying the report.

via NAR

Other homebuyer stats

According to Lautz, “The U.S. housing market is split into two groups: first-time buyers struggling to enter the market and current homeowners buying with cash.” Indeed, 26% of buyers paid in cash during the past year, another record high.

“Current homeowners can more easily make housing trades using built-up housing equity for cash purchases or large down payments on dream homes,” Lautz said. In 2024, the median down payment for all homebuyers was 18%. It was 23% for repeat buyers, the highest down-payment share for that group since 2003.

At the same time, the median age for homebuyer ages hit the all-time high of 56, up from 49 the previous year. The median age for repeat buyers hit an all-time high as well: 61, up from 58.

The typical homebuyer’s household income rose too, to a median of $108,800, up $1,800 year over year. Repeat buyers’ income rose even more, increasing $2,600 to a median of $114,300.

The share of married couples purchasing increased as well, making up 62% of all buyers, while the share of single female buyers rose slightly to 20%. (The share of single female first-time buyers increased by 5%.) In turn, the share of single males purchasing decreased to 8%; the share of unmarried couples decreased to 6%.

Across these demographics, 17% of homebuyers purchased a multigenerational home. The top reasons cited were, in order: saving on costs (36%), to take care of aging parents (25%), for children older than 18 moving back home (21%) and for children older than 18 who never left home (20%).

“As homebuyers encounter an unaffordable housing market, many are choosing to double up as families,” Lautz reflected. “Cost savings are a major factor, with young adults returning home — or never leaving — due to prohibitive rental and home prices. Meanwhile, elderly parents and relatives are moving in with family members as homebuyers reprioritize what matters most to them.”