Wall Street betting on housing stock

Boston Condos for Sale and Apartments for Rent

Wall Street betting on housing stock

If you’re thinking about buying a home, you may find yourself interested in the latest real estate headlines so you can have a pulse on all of the things that could impact your decision. If that’s the case, you’ve probably heard mention of investors, and wondered how they’re impacting the housing market right now. That could leave you asking yourself questions like:

- How many homes do investors own?

- Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

To answer those questions, here’s the real story of what’s happening based on the data.

Let’s start with establishing how many single-family homes (SFHs) there are and what portion of those are rentals owned by investors. According to SFR Investor, which studies the single-family rental market in the United States, there are eighty-two million single-family homes in this country. But how many of them are actually rentals?

According to data shared in a recent post, sixty-eight million (82.93%) of those homes are owner-occupied – meaning the person who owns the home lives in it. If you subtract that sixty-eight million from the total number of single-family homes (82 million), that leaves just about fourteen million homes left that are single-family rentals (SFRs).

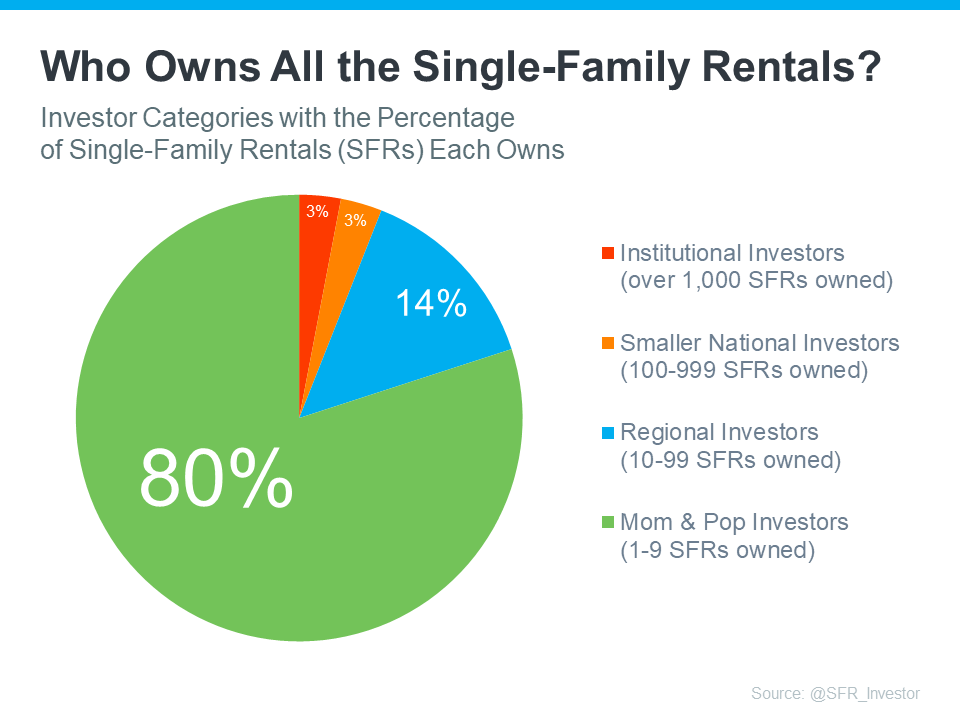

Do institutional investors own all of those remaining fourteen million homes? Not even close. Let’s take it one step further. There are four categories of investors:

- The mom & pop investor who owns between 1-9 SFRs

- The regional investor who owns between 10-99 SFRs

- Smaller national investor who owns between 100-999 SFRs

- The institutional investor who owns over 1,000 SFRs

These categories show that not all investors are large institutional investors. To help convey that even more clearly, here are the percentages of rental homes owned by each type of investor (see chart below):

As you can see in the chart, despite what the news and social media would have you believe, the green shows the vast majority are not owned by large institutional investors. Instead, most are owned by small mom & pop investors, like your friends and neighbors.

What’s actually happening is, that there are people out there, just like you, who believe in homeownership, and they view buying a home (or a second home) as an investment. Maybe they saw an opportunity to buy a second home over the last few years to use it as a rental and generate additional income. Or maybe they just decided to keep their first house rather than sell it when they moved up.

So, don’t believe everything you read or hear about institutional investors. They aren’t buying up all the homes and making it impossible for the average person to buy. That’s just not what the numbers show. Institutional investors are actually the smallest piece of the pie chart.

Bottom Line

While it’s true that institutional investors are a player in the single-family rental marketplace, they’re not buying up all of the houses on the market. If you have other questions about things you’re hearing about the housing market, let’s connect so you have an expert to give you the context you need.

_______________________________________________________________________________________________

Wall Street betting on housing stock

Housing stocks have tumbled for much of the year, but recent signs inflation is easing spurred a small rebound.

Softening inflation led investors to pile into housing stocks in recent weeks despite the downturn in the sector, the Wall Street Journal reported. Wall Street’s movement is hinged on hope for the Federal Reserve to slow ongoing rate hikes aimed at clamping down on inflation.

Since Nov. 9, the S&P 500 rose 5.8 percent through Friday’s closing bell. In that same period, shares for other brokerages, builders and mortgage lenders have outpaced the S&P 500, including brokerage Redfin’s shares rising more than 50 percent and home builder PulteGroup’s shares jumping 11 percent.

Redfin has been on a rollercoaster as of late. On Nov. 9, the company announced it was shuttering its iBuying business and laying off 13 percent of its staff, one of many brokerages to make cuts as mortgage rates soared and buyers vanished. One day later, the Labor Department revealed inflation reached its slowest pace in nine months.

That same day, Redfin’s stock rose 32 percent. The next day, it jumped another 21 percent. Despite its gains, the stock is still down 87 percent this year, demonstrating how far some housing stocks have dropped in recent months.

Investors aren’t banking on big improvement in the short-term performances of real estate companies, many of which are gearing up for continued difficulties in the near future. Instead, they’re hoping less Fed activity will calm the housing market and restore forward momentum to the sector.

“Do we think we’re going to make a lot of money on the home builders in the next three to six months? The answer is: We don’t know and we don’t assume we are,” Smead Capital Management CIO Bill Smead told the Journal. “But over the next 10 years we think we’re going to get rich in the home builders.

After passing 7 percent in a 21-year high, the average 30-year fixed-rate mortgage rate took its biggest drop in 41 years last week. The jump to 6.6 percent, which came amid a change in Freddie Mac’s methodology, was “welcome news,” chief economist Sam Khater told Bloomberg, but “there is still a long road ahead for the housing market.”