Boston Condos for Sale and Apartments for Rent

Compass once the predator now the prey

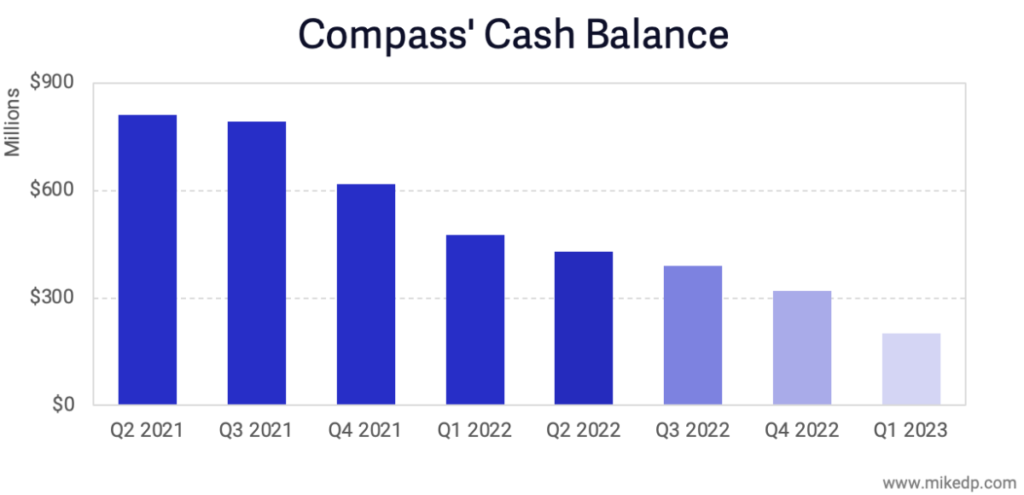

Rumors’ abound about Compass Real Estate demise. Let’s start from the beginning. Compass real estate came out the gate like a lion with close to $1B in assets today Compass stock is fading at $2.46 a share down 81.53% since the start of 2022.

Companies like Zillow, CoStar and Rocket Mortgage are certainly predators — flush with cash and opportunistically acquisitive in their outlook. Private equity firms with plenty of cash to deploy are the other opportunistic predators.

Compass Real Estate Sitting vulnerable as the prey

The prey is vulnerable businesses — diminishing cash balances with high cash burn. In other words, a typical real estate tech disruptor like Compass. Check this out:

- With its cash burn problem, Compass is a prime example (and noteworthy because it was in the predator camp for years).

- Although the specific players surrounding the rumor of Vista Equity Partners taking Compass private may be incorrect, the overall theme is spot on.

Real estate and the bottom line

Cash is king. In today’s market, a company’s cash flow determines if it is in control of its own destiny.

- If a company like Compass is burning cash and needs to raise additional funds, it will be forced to do so on someone else’s terms.

- But, if a company is cash flow positive with a solid balance sheet this is an environment that presents an incredible opportunity for the right player.