Well, of course, lower interest rates led to higher home prices!

Boston Condos and Real Estate for Sale

Well, of course, lower interest rates led to higher home prices!

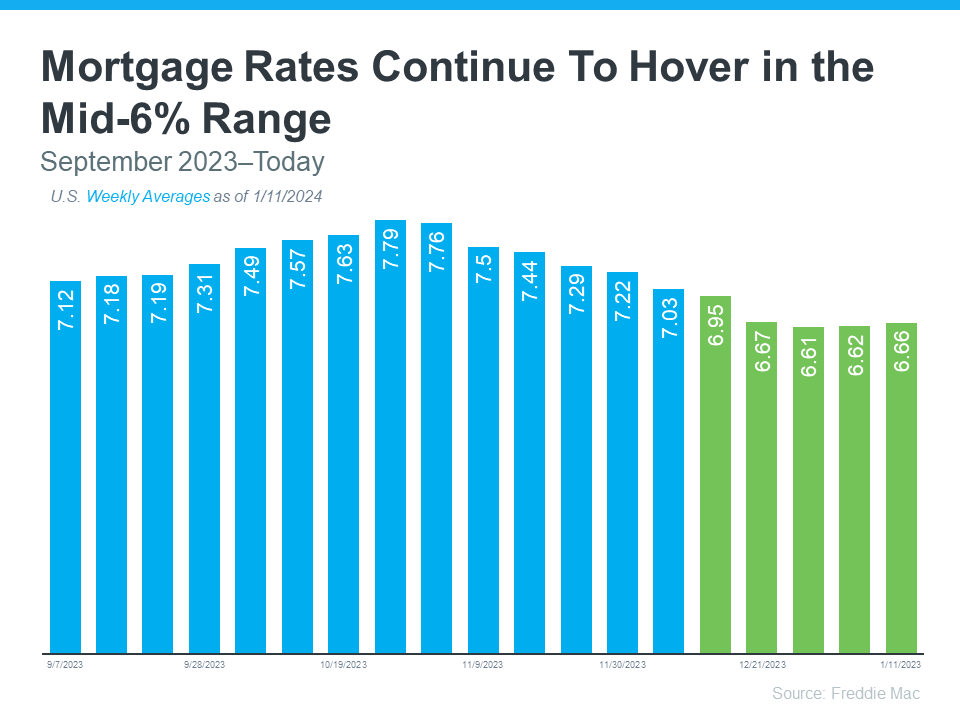

If you’ve been holding off on selling your Boston Seaport condo to make a move because you felt mortgage rates were too high, their recent downward trend is exciting news for you. Mortgage rates have descended since last October when they hit 7.79%. In fact, they’ve been below 7% for over a month now (see graph below):

And while they’re not going back to the 3% we saw during the ‘unicorn’ years, they are expected to continue to go down from where they are now in the near future. As Dean Baker, Senior Economist at the Center for Economic Research, explains:

“It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

Here are two reasons why this recent trend, and the expectation it’ll continue, is such good news for you.

You May Not Feel as Locked-In to Your Current Mortgage Rate

With mortgage rates already significantly lower than they were just a few months ago, you may feel less locked-in to the current mortgage rate you have on your house. When mortgage rates were higher, moving to a new home meant possibly trading in a low rate for one up near 8%.

However, with rates dropping, the difference between your current mortgage rate and the new rate you’d be taking on isn’t as big as it was. That makes moving more affordable than it was just a few months ago. As Lance Lambert, Founder of ResiClub, explains:

“We might be at peak “lock-in effect.” Some move-up or lifestyle sellers might be coming to terms with the fact 3% and 4% mortgage rates aren’t returning anytime soon.”

More Seaport Condo Buyers Will Be Coming to the Market

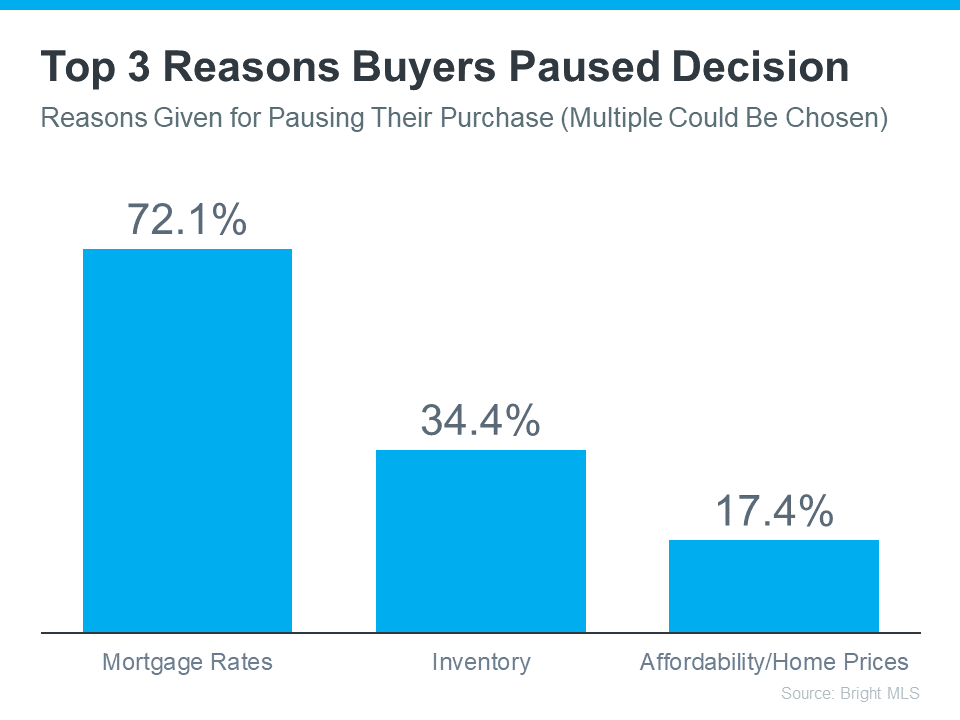

According to data from Bright MLS, the top reason buyers have been waiting to take the plunge into homeownership is high mortgage rates (see graph below):

Lower mortgage rates mean buyers can potentially save money on their home loans, making the prospect of purchasing a home more attractive and affordable. Now that rates are easing, more buyers are likely to feel they’re ready to jump back into the market and make their move. And more buyers mean more demand for your Boston Seaport condo.

Boston Condos for Sale and the Bottom Line

If you’ve been waiting to sell because you didn’t want to take on a larger mortgage rate or you thought buyers weren’t out there, the recent decline in mortgage rates may be your sign it’s time to move. When you’re ready, let’s connect.

___________________________________________________________________

Over the years I have joked about not being able to afford to buy my own home with today’s prices. In downtown Boston, the household income needed to qualify for a median-priced new home is in the 6 figures. In my neighborhood in Beacon Hill, $500,000 will only get you a studio or very small one-bedroom condo

Back when I bought my home I could not have afforded a 300K house. At the time interest rates were more than triple what they are right now. Prices are starting to cancel out those low rates in affordability calculations.

Here is a look at the last 30 days of downtown Boston condo sales in a few prime neighborhoods. It should be noted that home prices may not have reached their high for the year yet.

Boston Fenway Condo Sales

Sorry we are experiencing system issues. Please try again.

Boston South End Condo Sales

Sorry we are experiencing system issues. Please try again.

Boston Seaport Condos for Sales

Sorry we are experiencing system issues. Please try again.

Boston Condos and Real Estate for Sale

____________________________________________________________________________________________________________________________________________________________________________

Yeah, probably.

Following up on my earlier post, I need to clarify (i.e., correct) what I wrote earlier.

A New York City consultant had studied some data from the past thirty years which led him to the conclusion that housing prices fluctuated without regard to mortgage loan interest rates. This flies in the face of all logic and contradicts what most people believe, including me and just about every economist, statistician, and living person.

The data did not support the usual claim that rising interest rates causes a decrease in market prices, and dropping interest rates causes an increase in market prices.

Well, I’m happy to report that other, smarter people have done their own analysis, and have come to the opposite conclusion, or, at least, find enough holes in the consultant’s argument to make his results very suspect.

Jonathan J. Miller, co-founder, principal, president and CEO of residential real estate appraisal firm Miller Samuel has this to say:

I think a lot of the problem is the data set chosen.

The subject is the Manhattan market which does not always behave like the national market due to the international nature of the local economy as well as the predominant co-op housing stock (this has kept investors out during this recent boom).

He [the consultant] uses fixed mortgage rates yet adjustable rates are one of the primary drivers of the recent housing boom.

Plus he makes the assumption that mortgage rates are the only factor that causes prices to fluctuate. Over the past 10 years, the Manhattan housing market has been plagued by the chronic limitation in supply. So the premise of rising rates causing prices to slow would not be immediate if inventory is tight.

His conclusion:

Despite all this, my stats do show a clear pattern of influence of mortgage rates using a CPI adjusted 1-year adjustable and a 30-year fixed unadjusted.

More information:

– By Jonathan J Miller, Matrix

Contact me to find to set up an appointment to start your Boston condo-buying process.

SEARCH BOSTON CONDOS FOR SALE

For more information please contact one of our on-call agents at 617-595-3712.

Updated: Boston real estate and condos for sale in 2021