Boston Condos for sale Sale and Rent

The state of the Boston real estate market according to the Boston Federal Reserve

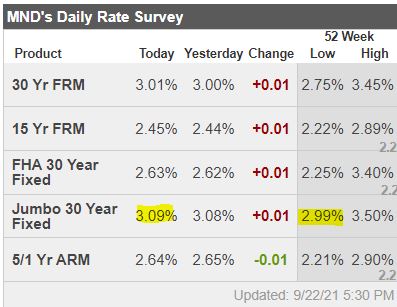

From Mortgage News Daily – thank you:

Mortgage rates were surprisingly steady today as the bond market reacted to a new policy announcement from the Fed. Perhaps “reacted” is the wrong word considering the market’s response. Specifically, the bond market (which dictates interest rates on mortgages and beyond) was hard to distinguish from most any other random trading day. That’s nothing short of impressive given what transpired.

So what transpired? That requires a bit of background, but let’s make it quick.

- The Fed is currently buying $120 bln / month in new Treasuries and MBS. These purchases greatly contribute to the low rate environment for mortgages.

- The Fed has done this, off and on in the past since 2009.

- 2013 was the first major example of the Fed “tapering” its monthly bond purchases after an extended period of accommodation. Markets freaked out and rates spiked at the fastest pace in years.

- Late 2021 is well understood to be the second major example of Fed tapering and markets have been speculating as to when it would become official.

Today’s announcement advanced the verbiage that suggests the Fed will begin tapering at the next policy meeting in November. Then, in the post-meeting press conference, Fed Chair Powell bluntly and explicitly confirmed the Fed is indeed planning on announcing the tapering plan at the next meeting unless the next jobs report is surprisingly bad.

Bonds definitely experienced some volatility during today’s Fed events, but again, that volatility existed within a perfectly normal range. The absence of a bigger market reaction is a testament to the Fed’s transparency efforts.

In short, they ended up saying almost exactly what they’ve been telegraphing in the past month of speeches, and markets revealed themselves to be positioned for an “as-expected” result. So not only was the Fed transparent, but markets were also fully betting on that transparency. Relative to some of the drama in 2013, today amounted to a perfectly threaded needle of epic proportions.

What does it mean for mortgage rates? Today? Nothing really. Lenders barely budged from yesterday.

All of the above having been said, sometimes it takes a few days for post-Fed rate momentum to truly kick in. Additionally, we’d expect some of today’s potential impact to instead be seen in the wake of the next jobs report on October 8th.

http://www.mortgagenewsdaily.com/consumer_rates/986363.aspx

Boston Condos for sale Sale and Rent

_____________________________________________________________________________________________________________________________

Boston Condos for Sale in 2021

Loading...

The number of closed sales increased in all reporting areas from a year ago, with double-digit increases for all markets except Boston condos. Notwithstanding these unusually high sales numbers, severe inventory shortages continued; the inventory of homes for sale dropped by double-digit percentages from a year ago in all reporting markets except Boston condos. The lack of inventory and high buyer demand continued to put upward pressure on prices and, once again, the median sale price rose in all markets, with double-digit increases for single-family homes. Contacts expected this “buying frenzy” to continue through the winter months. The Massachusetts contact again mentioned movement from urban areas to suburban and rural areas, and the Maine contact noted a substantial influx of out-of-state buyers.

For more information about District economic conditions visit: www.bostonfed.org/regional-economy