5 Things to Consider Before Purchasing Home Insurance

Boston Real Estate Search

5 Things to Consider Before Purchasing Home Insurance

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

- Covers Repairs and Rebuilding Costs: If your home is damaged by fire, storms, or other covered events, your policy helps pay for repairs or even a full rebuild.

- Protects Your Belongings: Many policies can also cover personal items like furniture, electronics, and clothing if they’re stolen or damaged.

- Provides Liability Coverage: If someone gets injured on your property, homeowner’s insurance can help cover medical bills or legal expenses.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it’s a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

Costs and Claims Are Rising

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

- More severe weather events and wildfires are leading to higher claims.

- Insurance companies are pulling out of high-risk areas, reducing options for homeowners in some states.

- Past rate increases haven’t kept up with the rise in claims.

- The cost to rebuild or repair homes has gone up due to higher material and labor costs.

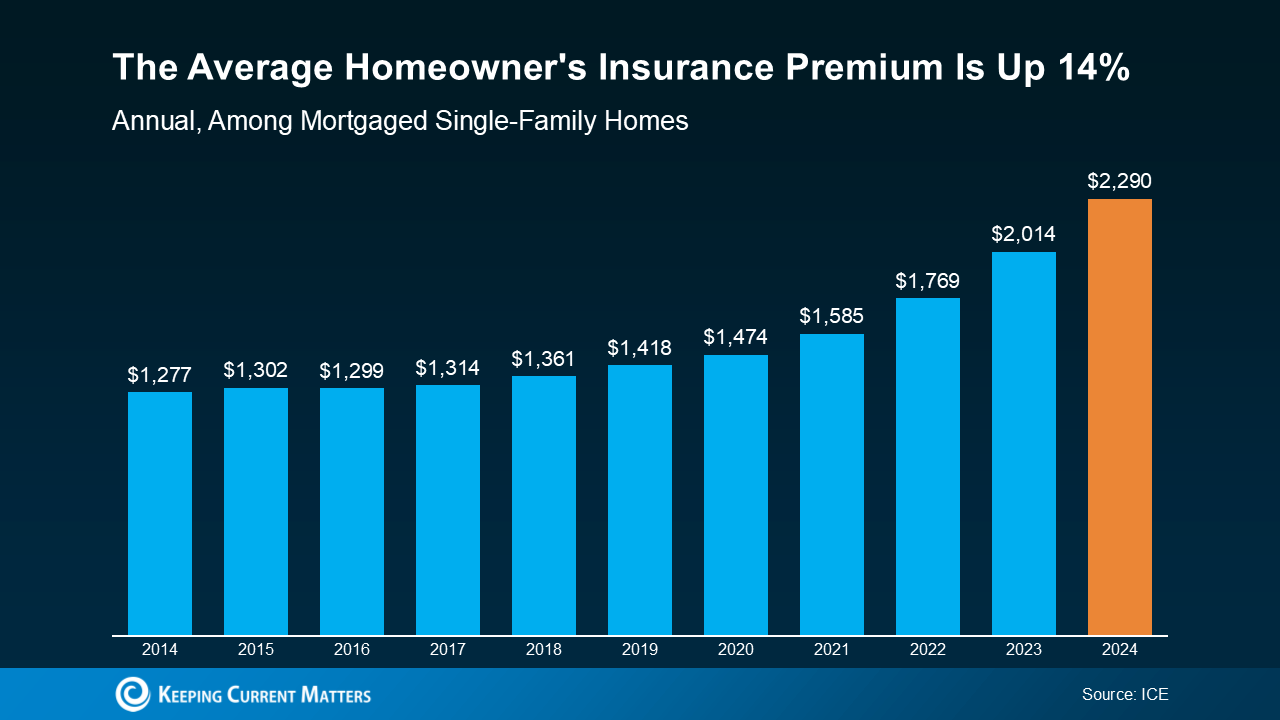

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

What You Can Do About It

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

Boston Condos for Sale and the Bottom Line

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible.

Love thy neighbor

Click Here to view: Google Ford Realty Inc Reviews for 2025

Peace be with you

***********************

5 Things to Consider Before Purchasing Home Insurance

Buying a home is a major milestone and an exciting endeavor. However, that comes with responsibilities and decisions. One decision has to do with buying home insurance. Not only is this something the lender requires, but it also provides you with peace of mind. If something should happen to your property and possessions, you have protection.

What Is Home Insurance?

In simple terms, home insurance offers financial protection in case a disaster damages or destroys your home. Not only does a standard policy protect the dwelling but also your possessions. You can also add coverage to the policy, such as a detached garage, barn, or workshop.

Typically, a home insurance policy includes liability, which is your legal responsibility for property damage or injury to another party. For instance, if someone parks in your driveway and your home catches fire, which destroys their vehicle, your home insurance protects your house, belongings, and the other person’s automobile.

What to Consider Before Buying a Policy

Before signing on the dotted line with any insurance provider, you should consider these five things.

Comparison Shop

Since every insurer and policy is unique, start by shopping around for the right home insurance. The goal is to secure the most coverage at the lowest rate. An excellent place to start is by reading Geico home insurance reviews. This reputable company has great options and affordable premiums. From there, you can see what other insurance providers offer for homeowner’s insurance.

Coverage

As you can imagine, the more coverage you have, the more you’ll pay in premiums. The key is to work with a reputable insurer to get the protection you need while avoiding what you don’t need. In other words, when it comes to coverage for home insurance, work with an insurance company that can customize a policy to your specific needs.

Deductibles

You also need to understand what deductibles are and how they work. A deductible is an amount you’re required to pay whenever filing an insurance claim. Rather than pay out-of-pocket, the insurer deducts the deductible from the check you receive to cover the loss. Now, the lower your deductible gets the higher your premium. If you want to reduce what you pay for home insurance, consider increasing the amount of your deductible.

Cash Value Versus Replacement Cost

This is another important piece of information about home insurance. When buying a policy, you can go with cash value or replacement cost. With cash value, the insurer pays for repairs or replacement but only up to the payout limit written in the policy, minus depreciation. That means if your house burned to the ground, the insurance probably wouldn’t pay enough for a complete rebuild.

As for replacement cost, this pays for repairs or the replacement of your home and personal possessions, again up to the policy limits. The big difference between the two is that with replacement cost, the insurance company doesn’t deduct anything for depreciation. For that reason, replacement cost better covers having your home rebuilt if completely destroyed.

Discounts

Insurance companies offer bundled packages that can save you a lot of money. The same goes for available discounts. As you compare different insurers and even while reading Geico home insurance reviews, find out what discounts they offer. As an example, having a home security system warrants a discounted premium. The more discounts, the more you save.

Boston Real Estate Bottom Line

Along with doing outside research of home insurance companies, consider the other things mentioned. The more educated you are on home insurance, the better you can select the right policy without compromising protection.