2024 – Demand for housing inventory

Boston Condos for Sale and Apartments for Rent

Have we seen the peak in housing inventory for 2024? The best part about 2024 has been that higher mortgage rates have created an inventory buffer, so if the economy gets softer and rates fall, we have many more homes to work with than we had in 2020-2023.

I have consistently written that with mortgage rates above 7%, inventory should grow between 11,000-17,000 and this year it has happened six times perfectly in the channel. However, as mortgage rates have fallen recently, I haven’t been able to hit my targets, which isn’t a surprise. And last week, just before this holiday weekend, we saw the first tiny decline in inventory week to week.

Weekly housing inventory data

Despite what has happened with inventory in the last few months, 2024 has been a positive story because we got off historically depressed active inventory levels. As part of “team higher rates” in 2021 and 2022, this is precisely what I wanted to see happen because we can’t assume mortgage rates will stay elevated in the 7%-8% range.

Many months ago, I talked about the softer labor market and how that should make mortgage rates fall, which it has. And I feel much better about the housing market now with more inventory, which I talked about on CNBC recently.

- Weekly inventory change (Aug. 23-Aug. 30): Inventory fell from 704,744 to 704,335

- The same week last year (Aug. 25 -Sept 1): Inventory rose from 503,924 to 509,562

- The all-time inventory bottom was in 2022 at 240,497

- The yearly inventory peak for 2024 was last week at 704,744

- For some context, active listings for this week in 2015 were 1,204,810

New listings data

New listing data is experiencing its traditional seasonal decline. 2024 is the second-lowest new listing year recorded in history. Here are the number of new listings for last week over the previous several years:

- 2024: 59,195

- 2023: 59,081

- 2022: 62,775

Price-cut percentage

In an average year, one-third of all homes take a price cut — this is standard housing activity. Rising mortgage rates last year and this year have created a growing level of price cuts, especially with inventory rising. This data line has recently slowed down with falling rates.

A few months ago, on the HousingWire Daily podcast, I discussed that the price-growth data would cool down in the year’s second half. Here are the price-cut percentages for last week over the previous few years:

- 2024: 39.3%

- 2023: 36%

- 2022: 39%

Weekly pending sales

Below is the Altos Research weekly pending contract data to show real-time demand. There is no growth in the week-to-week data and we are starting to create a more significant gap in the year-over-year data. I’m writing to caution everyone that starting in August last year, mortgage rates began to head toward 8%, so we will have some super easy comps to show growth in some of the data lines year over year going out.

- 2024: 368,076

- 2023: 358,408

- 2022: 404,076

10-year yield and mortgage rates

My 2024 forecast included:

- A range for mortgage rates between 7.25%-5.75%

- The 10-year yield between 4.25%-3.21%

Even with a negative job revision print and a baby pivot by Jerome Powell recently, the famous 3.80% level has again held. Unlike the Gandalf line in the sand in 2023 at 3.37%, this is more like Game of Thrones — with Hodor holding up the door as the whitewalker creatures push to break it open. In time, with more economic and labor data weakness, this will break. There was not much movement in the 30-year mortgage last week, but the spreads were good.

Mortgage spreads

Mortgage spreads were a negative storyline in 2023, as the collapse of Silicon Valley Bank and the resulting banking crisis pushed them to new cycle highs. We haven’t had any banking crisis events this year and the Federal Reserve is starting its rate-cut cycle. The closer we get to those rate-cuts, the more the spreads should improve. They improved a bit earlier than I thought, but we can see the difference in 2023 in the chart below.

If we took the worst levels of the spreads from 2023 and incorporated those today, mortgage rates would be 0.58% higher right now. While we are far from being average with the spreads, the fact that we have seen this improvement is a plus this year.

Purchase application data

Before I give the weekly update on purchase apps, I would say I don’t think people are reading the data correctly because they are saying we haven’t had a positive move here. Let me explain.

1. Purchase apps are very seasonal. The heat months are the second week of January to the first week of May; after May, volumes always fall.

2. The last 12 weeks have been the best 12 weeks for purchase apps for the year, primarily due to the year being negative on the weekly data. So, this is a positive 12-week curve.

3. The last two times rates fell in 2022 and 2023 — around the middle of November, closer to the seasonal volume push — the positive growth in purchase apps was stopped when rates went higher.

4. Typically, purchase apps look forward 30-90 days. I have discussed before that I don’t see how existing home sales can have sustained growth unless rates get below 6%. That’s how the builders have been able to grow sales since the lows in 2022. This recent HousingWire Daily podcast goes into this storyline, explaining why this is the price we pay with home prices escalating out of control and at record highs.

Since mortgage rates have fallen more than 1% recently, we will draw a line in the sand at that point and track purchase application data for the rest of the year. In the last 12 weeks, purchase application data has had seven positives versus five negative prints. Last week saw weekly purchase apps grow 1%.

Since mortgage rates started to fall in November 2023, the week-to-week data shows 19 positive prints, 18 negative prints and two flat prints. As we can see from the data, not much is happening. The question now is whether rates can stay lower and go lower for the first time now that people are more concerned with the economy.

Demand for housing inventory

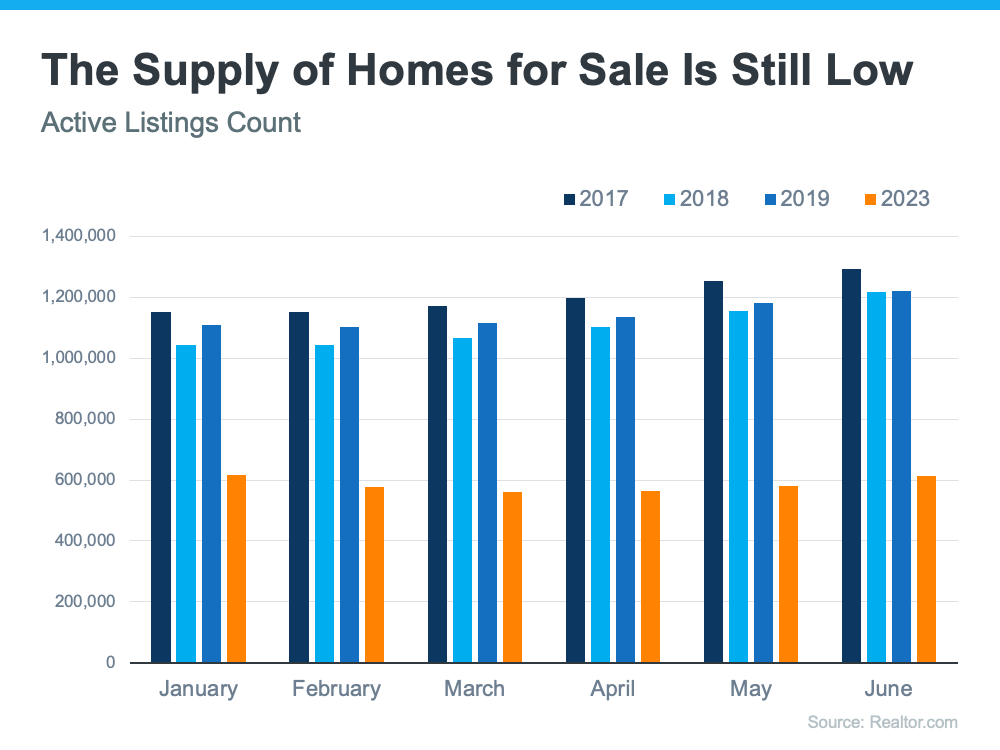

One of the biggest challenges in the Boston condo for sale market right now is how few homes there are for sale compared to the number of people who want to buy them. To help emphasize just how limited housing inventory still is, let’s take a look at the latest information on active listings, or homes for sale in a given month, as it compares to more normal levels.

According to a recent report from Realtor.com:

“On average, active inventory in June was 50.6% below pre-pandemic 2017–2019 levels.”

The graph below helps illustrate this point. It uses historical data to provide a more concrete look at how much the numbers are still lagging behind the level of inventory typical of a more normal market (see graph below):

It’s worth noting that 2020-2022 are not included in this graph. That’s because they were truly abnormal years for the housing market. To make the comparison fair, those have been omitted so they don’t distort the data.

When you compare the orange bars for 2023 with the last normal years for the housing market (2017-2019), you can see the count of active listings is still far below the norm.

What Does This Mean for You?

If you’re thinking about selling your house, that low inventory is why this is a great time to do so. Buyers have fewer choices now than they did in more normal years, and that’s continuing to impact some key statistics in the housing market. For example, sellers will be happy to see the following data from the latest Confidence Index from the National Association of Realtors (NAR):

- The percent of homes that sold in less than a month ticked up slightly to 74%.

- The median days on market went down to 18 days, showing homes are still selling fast when priced right.

- The average number of offers on recently sold homes went up to 3.3 offers.

Boston Condos and the Bottom Line

When supply is so low, your house is going to be in the spotlight. That’s why sellers are seeing their homes sell a little faster and get more offers right now. If you’ve thought about selling, now’s the time to make a move. Let’s connect to get the process started.

________________________________________________________________________________

The pace of new home listings is gaining steam, a welcome development in the face of high demand from Boston condo buyers, Redfin reported.

A new Redfin report found the number of newly listed homes for sale during the four weeks ended Feb. 20 fell just 2% from last year, the smallest decline since mid-November.

Home Sales Data

The report found those listings were met with “hearty demand” as pending home sales rose 1% during the first increase since-mid January. Home sale prices, asking prices, mortgage payments and share of homes selling within days of being listed also set new record highs.

Despite all the highs, the total number of homes for sale hit a new all-time low.

Redfin deputy chief economist Taylor Marr said there’s good news for homebuyers in that each week more homes are being listed.

“There is growing evidence that January’s dramatic drop in new listings was only a temporary blip driven by heavy winter storms and the spike in Covid cases, so homebuyers may have some hope for better selection in the coming spring season,” Marr said in a press release.

In the four weeks ended Feb. 20, active listings fell 25% year over year to an all-time low of 452,000 and were down 49% from the same period in 2020. The median asking price rose 15% from 2021 to another high of $385,327 and was up 27% from 2020. Meanwhile, the median sale price increased 15% year over year to $358,750, another record high.

Homes Under Contract

Forty-five percent of homes went under contract with an accepted offer within one week of being listed, up from 39% last year, setting another record. Additionally, 43% of homes sold above list price, up from 32% last year.

Real Estate Mortgage Applications

The report noted a 10% week-over-week decrease in mortgage applications during the week ended Feb. 18, and 30-year mortgage rates fell to 3.89% for the week ended Feb. 24.

Boston Condos for Sale and Apartment Rentals

2021: Demand for housing inventory and future of the American home

Boston Condos for Sale and Apartment Rentals

+++++++++++++++++++++++++++++++++++++++++

Boston Condos for Sale

Loading...

2021: Demand for housing inventory

2021: Demand for housing inventory

In today’s housing market, it seems harder than ever to find a home to buy. Before the health crisis hit us a year ago, there was already a shortage of homes for sale, especially affordable homes in downtown Boston. When many homeowners delayed their plans to sell at the same time that more buyers aimed to take advantage of record-low mortgage rates and purchase a home, housing inventory dropped even further. Experts consider this to be the biggest challenge facing an otherwise hot market while buyers continue to compete for homes. As Danielle Hale, Chief Economist at realtor.com, explains:

“With buyers active in the market and seller participation lagging, homes are selling quickly and the total number available for sale at any point in time continues to drop lower. In January as a whole, the number of for sale homes dropped below 600,000.”

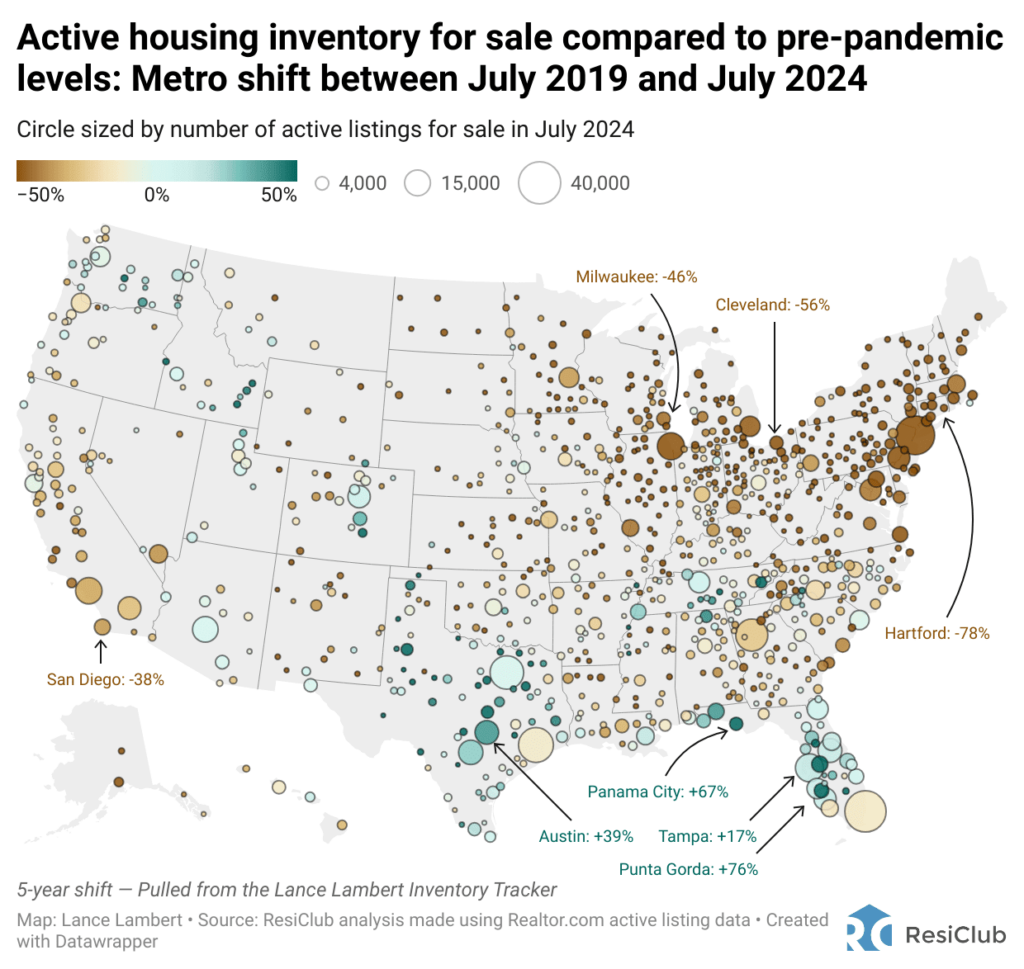

Every month, realtor.com releases new data showing the year-over-year change in inventory of existing homes for sale. As you can see in the map below, nationwide, inventory is 42.6% lower than it was at this time last year:

Does this mean houses/condos aren’t being put on the market for sale?

Not exactly. While there are fewer existing homes being listed right now, many homes are simply selling faster than they’re being counted as current inventory. The Massachusetts real estate market is that competitive! It’s like when everyone was trying to find toilet paper to buy last spring and it was flying off the shelves faster than it could be stocked in the stores. That’s what’s happening in the housing market: homes are being listed for sale, but not at a rate that can keep up with heavy demand from competitive buyers.

In the same realtor.com report, Hale explains:

“Time on the market was 10 days faster than last year meaning that buyers still have to make decisions quickly in order to be successful. Today’s buyers have many tools to help them do that, including the ability to be notified as soon as homes meeting their search criteria hit the market. By tailoring search and notifications to the homes that are a solid match, buyers can act quickly and compete successfully in this faster-paced housing market.”

The Good News for Boston Homeowners

The health crisis has been a major reason why potential sellers have held off this long, but as vaccines become more widely available, Boston homeowners will start making their moves. Ali Wolf, Chief Economist at Zonda, confirms:

“Some people will feel comfortable listing their home during the first half of 2021. Others will want to wait until the vaccines are widely distributed.”

With more Boston condo owners are getting ready to sell later this year, putting your condominium on the market sooner rather than later is the best way to make sure your listing shines brighter than the rest.

When you’re ready to sell your Boston downtown real estate, whether it’s a Beacon Hill, Back Bay, or a high-rise condo you’ll likely want it to sell as quickly as possible, for the best price, and with little to no hassle. If you’re looking for these selling conditions, you’ll find them in today’s market. When demand is high and inventory is low, sellers have the ability to create optimal terms and timelines for the sale, making now an exceptional time to move.

Boston Condos and the Bottom Line

Today’s Boston real estate market is a big win for sellers, but these conditions won’t last forever. If you’re in a position to sell your house now, you may not want to wait for your neighbors to do the same. Let’s connect to discuss how to sell your house safely so you’re able to benefit from today’s high demand and low inventory.

Boston Real Estate Original Blog Post

Boston condo market is starting with condominium values are up.

However, there is one problem that may have a huge impact on the Boston condo market and that’s the lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping up.

Here are the thoughts of a few Real Estate industry experts on the subject:

National Association of Realtors

“Total housing inventory at the end of November dropped 7.2 percent to 1.67 million existing homes available for sale, and is now 9.7 percent lower than a year ago (1.85 million) and has fallen year-over-year for 30 consecutive months. Unsold inventory is at a 3.4-month supply at the current sales pace, which is down from 4.0 months a year ago.”

Joseph Kirchner, Senior Economist for Realtor.com

Sam Khater, Deputy Chief Economist at CoreLogic

“The increases in single-family permits and starts show that builders are planning and starting new construction projects, that’s a good thing because it will help to relieve the shortage of homes on the market.”

“Inventory is tighter than it appears. It’s much lower for entry-level buyers.”

If you are thinking of selling your Boston condo, now may be the time. Demand for your Boston condos will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price.

For more information please call John Ford at 617-595-3712